How are you tracking your revenue? Your payment processor (e.g. Stripe) tells you general sums, and hopefully you keep up with how much money you made this month, how many dollars entered and left your bank account, and how many new customers signed up.

Profitwell is a SaaS metrics dashboard that provides a deeper dive into your financials. It’s one of the tools that we recommend SmartLogic’s clients use to keep track of where their revenue comes from. Profitwell gives you the information to narrow your target focus and, hopefully, increase revenue.

Find out where your revenue is really coming from

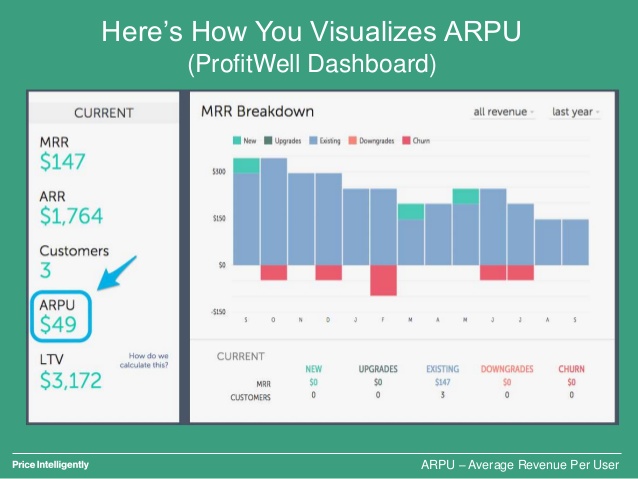

The breakdown of revenue sources looks different for every company. For some, growth comes from getting existing customers to upgrade and spend more; for others the majority of their monthly revenue may come from signing up new customers. A number from your payment processor at the end of the month only tells you how much money you made, not how you made it.

This dashboard breaks down that basic number so you can see your strengths and weaknesses. Maybe you think you’re doing great because your payment processor says you’re making money each month. What it doesn’t tell you, though, is that just as fast as new customers are signing up, current customers are walking away. Knowing exactly how you’re growing can help you focus on a path to a more profitable future.

Focus on how you can grow

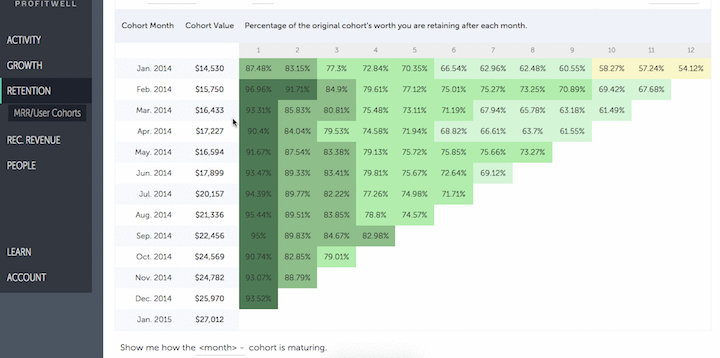

Churn and growth rates become clearer once you begin using a product like Profitwell.

People will tell you that retention is the most important thing, but business advice isn’t one-size-fits-all, and Profitwell helps you realize where you should focus. Maybe your company’s growth is relatively slow compared to where you want it to be, but your retention is excellent. Within the dashboard you can see your strengths and weakness and act on them. What you see using the dashboard will probably be different, but equally helpful.

Get off the emotional rollercoaster

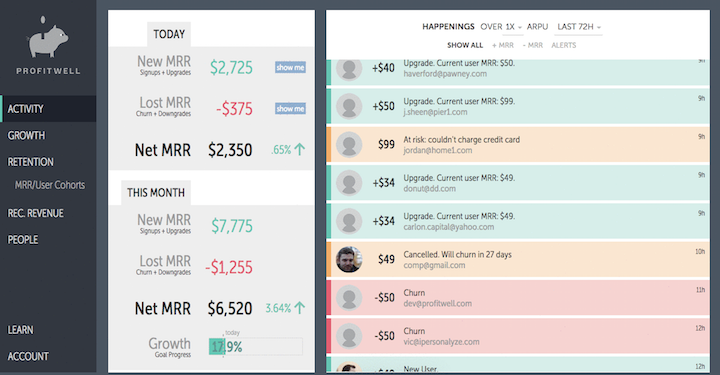

Determining monthly recurring revenue can be tricky when you need to factor income from yearly plans. Take the amount of each annual payment, divide it by 12, and add that figure to the monthly recurring revenue. Revenue can look like it’s spiking if you’re not using the right metrics tool.

Watching the fluctuation of monthly income figures can put you on an emotional roller coaster. Maybe one month you'll have a client sign up for an annual plan, then the next sell nothing but less-lucrative monthly plans. Overall you would have had a stronger month, but you feel bad because technically, your income went down. There is definitely a psychological benefit to a product like Profitwell, because it helps smooth out the rough edges.

Keep innovating

Profitwell isn’t resting on their laurels — they are continuing to work towards making it easier to consume your financial information. I’m involved with a beta project that will keep companies from losing out on revenue when a customer’s credit card expires. Profitwell is connected to your payment processor, so they already know when credit cards are going to expire or when customers need to update their information.

Instead of a company losing out on money or having to build an internal product, which would probably take a week or two, Profitwell takes care of the issue. Profitwell sends out emails on your behalf reminding customers to update their credit card info. It then lets the customer update the card info directly without the extra step of going to another site.

In straight dollars and cents terms, this beta product makes companies money. They recover dollars for companies from people whose credit cards would have expired.

Want more business advice?

Follow SmartLogic on Twitter.